How Startups are Valued from Pre-seed to Series B

Startup valuation is one of the key aspects which founders and investors are most interested in. The way of assessing their valuation at each stage can determine their trajectory and growth potential. Here we look at the factors which affect a startup’s valuation from pre-seed to Series B.

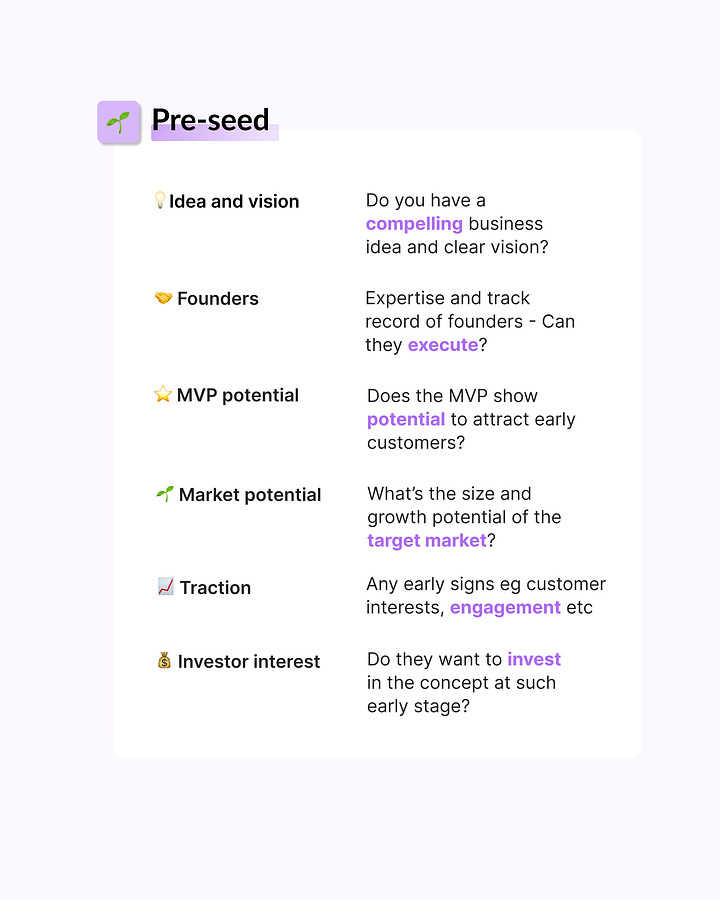

🌱 Pre-seed

In pre-seed, the valuation is mainly based on if there is a compelling idea and vision or not. As it is at such an early stage, there are little to no financial metrics or product ready to assess the growth, so valuation could be quite subjective.

In most cases, the emphasis will be on the founding team. Do they have the skills and experience, and most importantly - are they capable of executing?

Investors at this stage will likely compare them with other companies as they want to see if they’ll likely become the ‘next big thing’. So if an investor decides to invest at this early stage, they’re likely to be interested in seeing the growth of the startup.

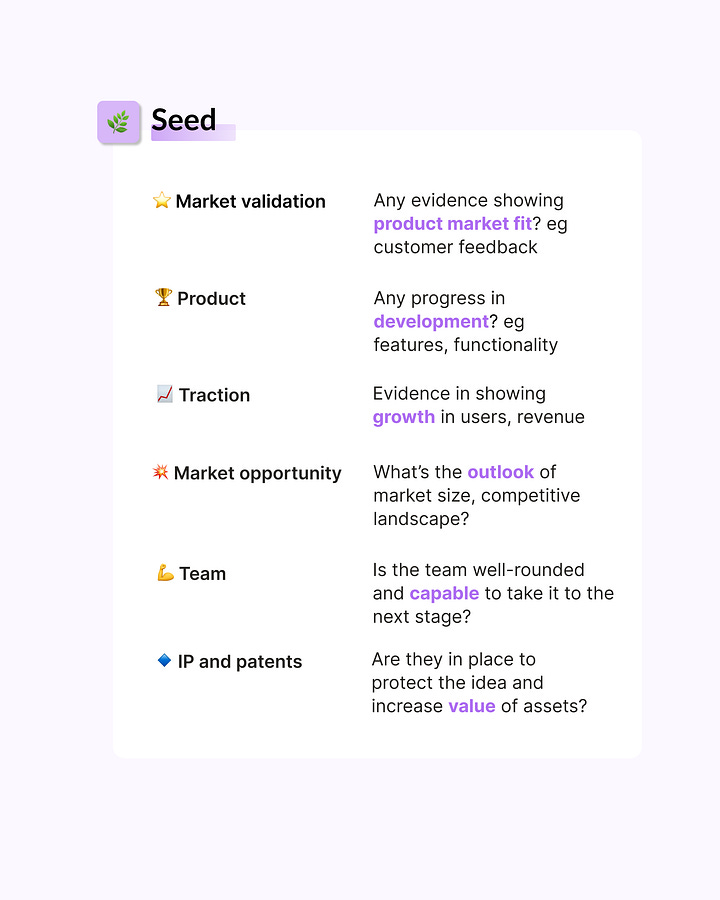

🌿 Seed

At seed stage, startups should already be looking at validating their business idea. Have they understood the market landscape well? Is there a gap in the market that the startup can fill? How well did they understand their target audience? This could be customer feedback to see if there’s a product-market fit. If they have onboarded customers/ users, there will be signs of traction.

Here, the team will have more responsibility to execute their idea from pre-seed stage. Along with product development, they should also be in the process of receiving intellectual property (IP) and patents to protect their idea.

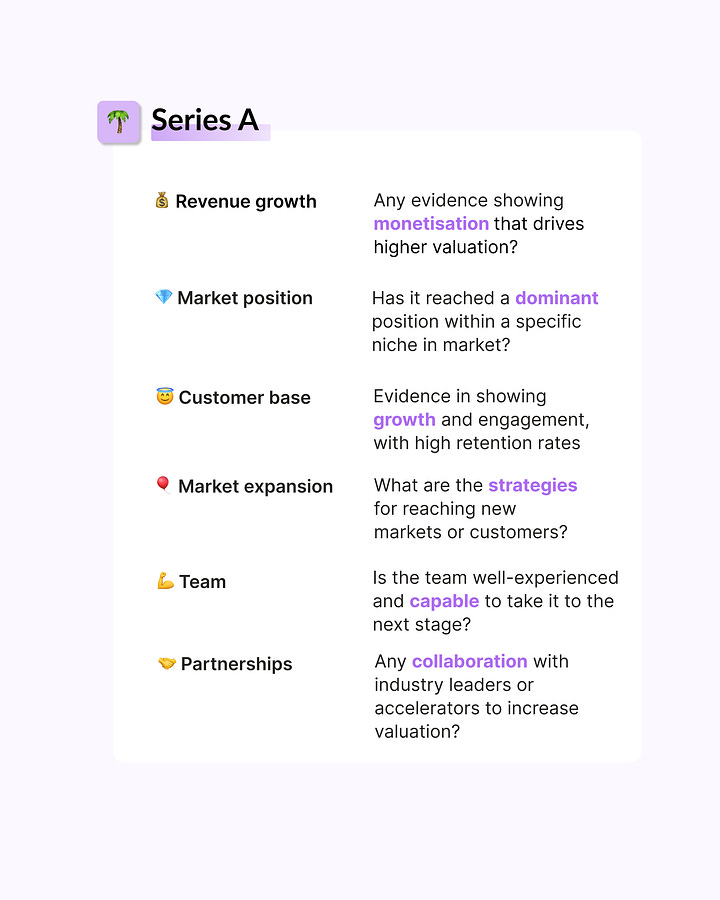

🌴 Series A

In Series A, this is where traction and growth potential kicks in. Startups will have started monetising and there will be growth in revenue and users. Marketing strategies and distributing channels will help expand the client base and reach either new markets or customers.

Investors will also be interested in knowing if the startup has reached a ‘dominant’ position in the market and any partnerships to help expand the company more. The team will expand to fit that purpose, and it is important for the leadership team to execute well and lead the startup for more trajectory growth.

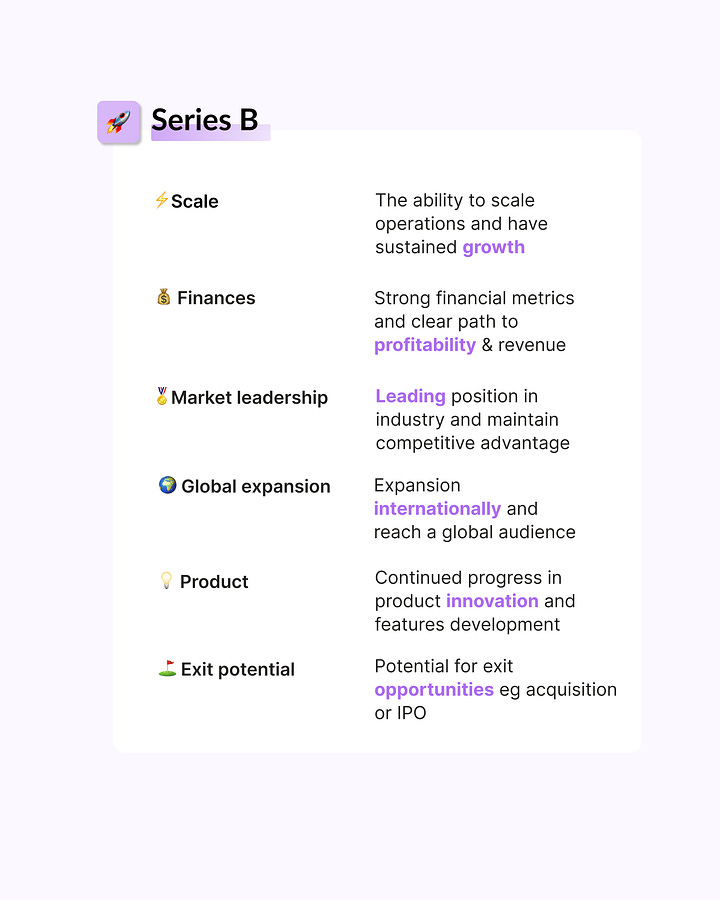

🚀 Series B

At this stage, the key aspect is the scalability. Startups will have pipelines and strategies for full-throttle growth. More emphasis will be on the numbers - finances, profitability, revenue etc. Further expansion into international markets will be in place, and the startup will be in a leading position and be maintaining a competitive advantage.

Here, investors will be interested in whether the startup will achieve a successful exit, either through acquisition by another company or by going public through an initial public offering (IPO).

Conclusion

Here is a Linkedin post I wrote about, which summarises the key questions startups might want to ask themselves at each stage to determine their valuation. I will also attach the graphics below for each stage 👇

Download the pdf version here 👇

Resources

💊 Healthtech

Healthtech Pigeon newsletter - #150 - Failure is a type of exit, right?: Lessons learnt from the fall of Babylon Health

Techfem: Emerging women’s health startups and challenges in FDA approval

What the Health?!: The title always gets me. Australian VC health funds, M&A, Google events and many more.. (definitely not missing out)

Big Picture Medicine Podcast: Who’s this techbio company NVIDIA is investing $50M into?

Health Beyond Tomorrow Podcast: Microsoft’s Chief Clinical Information Officer dives into the growth of Azure’s OpenAI in digital health

🚀 Startups & VC

BaseTemplates ‘The Full Stack Entrepreneur’ Newsletter: Founder stories and deep dives into all things startups, along with free pitch deck templates. Who doesn't love an aesthetically design deck and it’s FREE?!

Startup & VC job board: VC jobs updated weekly for you

Harry Stebbings’ 20VC Podcast: Why entrepreneurship isn’t for everyone. Love the quick fire rounds in each episode

Dr Andre Retterath’s Data Driven VC newsletter: Revealing the productivity tool stack VCs use

Thank you for reading! If you liked it, share with your friend, family or a fellow founder who might find this useful.

Follow me on Linkedin & Twitter for more updates like this.

What do you think of it?

⭐️⭐️⭐️⭐️⭐️ Love it!

⭐️⭐️⭐️⭐️ It's okay!

⭐️⭐️⭐️ Good

⭐️⭐️ Hmm

⭐️ No

Please let me know if you have any suggestions of what to see next or any feedback! I would value your input.

If you have any interesting articles or stacks, please get in touch! I would love to feature in my next edition! 😇